About Us

Advertise With Us

RSS Feed | Content Syndication

Terms & Conditions

Privacy Policy

Contact Us

BollywoodShaadis.com © 2025, Red Hot Web Gems (I) Pvt Ltd, All Rights Reserved.

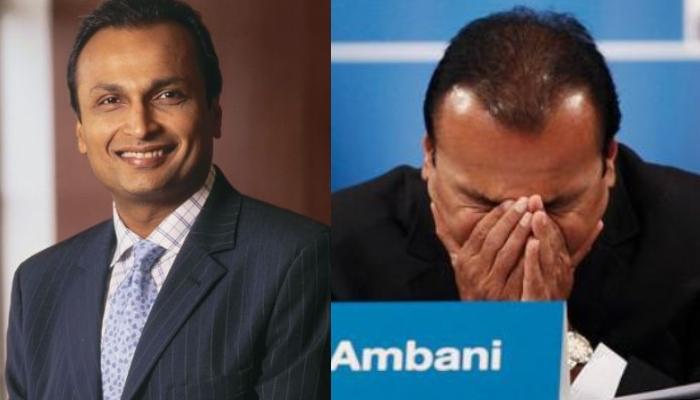

Son of Indian business tycoon, Dhirubhai Ambani, Anil Ambani, was one of the most successful businessmen in the world. Born on June 4, 1959, Anil Ambani’s business acumen was unbeatable. Anil was known for his active involvement in the Reliance Group and significant wealth. Not just in the business circle, Anil was also known for his political powers.

The business tycoon, who got married to actress, Tina Munim, had a close association with many celebrities. Known for his flamboyant nature, Anil was seen in almost every party circle. The once sixth richest person in the world declared himself bankrupt, owing crores of debts to his name. Let us look at the rise and fall of Anil Ambani.

Also Read: Anil Ambani And Tina Ambani's Lifestyle: Strict Parenting, Remote Holidays, Luxurious Yacht, More

After the death of Dhirubhai Ambani on July 6, 2002, Anil Ambani and his elder brother, Mukesh Ambani, started managing Reliance Group, a conglomerate founded by their father, for two months. Dhirubhai Ambani left Rs. 25,000 crore worth of business empire for his sons. But slowly, Anil and Mukesh had tiffs over decisions related to the business. There were three main reasons for their tiff:

Dhirubhai Ambani died without any clear succession plan or will for his sons, Mukesh and Anil, because of this, there was no clear control of any of them over the business.

The second reason behind the conflict was Anil and Mukesh’s different vision towards the business. On one side, Mukesh Ambani wanted to invest in the telecom business, Anil wanted to grow the power generation business on the other side. But Reliance only had money to invest in any one project, and finally, Reliance invested in the telecom business.

Continue reading below

The third reason for the dispute was Anil Ambani’s flamboyant lifestyle. He joined politics, and Anil became a Rajya Sabha MP through the Samajwadi party. It was also reported that Anil Ambani’s family was against his marriage with actress, Tina Munim as she came from the world of fashion and glamour. However, the Ambani family had to agree to Anil’s choice as he threatened to leave the house.

Recommended Read: Shark Tank India Season 3: Meet The 6 New Sharks On The Panel: From Ritesh Agarwal To Radhika Gupta

After witnessing the increasing dispute between Anil and Mukesh, their mother, Kokilaben Ambani, divided the Reliance Group equally between the two brothers. On June 18, 2005, she officially announced the division. Mukesh received the Reliance Industries and IPCL, which is known as Reliance Industries, under which came crude oil refining, petrochemicals production, and oil and gas exploration. It was Reliance’s core business.

On the other hand, after the division, Anil got Reliance Communications, Reliance Capital and Reliance Power. These companies together were called Anil Dhirubhai Ambani Group (ADAG). Mukesh got companies which were generating massive cash and profits. However, the companies that Anil got were generating comparatively low profits, but it had high potential for the future.

After the division, Anil had the freedom to take sole decisions for his business, without anyone’s interference. Merely after two days of settlement, Anil made huge promises and announced various new projects worth thousands of crores in ADAG. Through Reliance Power, he announced a power generation plan worth Rs. 80,000 crores. He also announced an investment of Rs. 2000 crores in Retail Capital and also intended to enter the infrastructure and entertainment industry.

He took loans worth thousands of crores from various banks to finance all these projects. And within a few days, he also launched the IPO of Reliance Communication. It was one of the greatest achievements of Anil Ambani. Under his leadership, Reliance Communications became one of the largest telecommunications companies in India. It also introduced affordable mobile services in India with the help of CDMA technology.

Anil also entered the power sector by establishing Reliance Power. He also made history for securing a full subscription to the Reliance Power IPO in less than 60 seconds. It was the biggest IPO during that time. Anil’s total wealth surpassed Rs. 4 lakh crores in 2007.

Within one year of settlement, Anil and Mukesh’s net worth increased rapidly. Mukesh Ambani’s net worth increased from 8.5 billion dollars to 20 billion dollars. On the other hand, Anil Ambani’s net worth increased from 5.7 billion dollars to 18 billion dollars. With the growth of his business, Anil Ambani’s net worth saw a rapid growth in 2008 from 18 billion dollars to 42 billion dollars, making him the sixth richest person in the world.

Also Read: Meet Motivational Speaker, Gaur Gopal Das, Left Engineering To Become A Monk, Author And Much More

While flourishing in his business, Anil Ambani could never imagine his downfall. A combination of factors, including his aggressive expansion, high debts and unfavourable market, attributed to the fall of the scion. Let us look at some attributes that led to the fall of Anil Ambani’s business empire.

In 2008, Anil Ambani’s ADAG group’s profit was around Rs. 9,000 crores, but 75 per cent of the profit came from one company, Reliance Communication. Anil Ambani’s Reliance Communications could not compete in the telecom sector as it could not upgrade to 4G because of its huge debts. Whereas networks like Vodaphone and Airtel came up with plans with 4G networks, people switched from Reliance to Vodaphone and Airtel for better internet.

Anil Ambani’s next fall came in the form of Reliance power. Reliance Power at Dadri and Shahpur had two gas fire power plants, which used natural gas to produce electricity. But Anil depended on his brother, Mukesh Ambani, to get natural gas.

During the time of partition, there was an agreement that Reliance, at the rate of 2.3 dollars per unit, would provide natural gas to Reliance Power. However, Mukesh doubled the price, and Anil filed a case against Mukesh in the Bombay High Court for breach of contract, but Mukesh challenged the decision in the Supreme Court. However, the Supreme Court gave the verdict in Mukesh’s favour. Anil had no other option than to buy expensive gas. After his much-awaited Dadri project got shut, Anil was shattered. By 2015, except for Reliance Capital, all his other companies were on the verge of shutting down.

By 2015, ADAG accumulated a debt of Rs. 1,25,000 crores. Despite such a bad condition, Anil entered into a new industry and purchased Pipavav Defense for Rs. 2000 crores. The company was already losing and had a debt of Rs. 6,700 crores. The company’s name was changed later and was called Reliance Defense. Since he had no knowledge of Defense and the debts were soaring high, Anil could never deliver the contracts on time, and soon it was shut.

In 2016, Anil Ambani got the biggest jolt with the arrival of Mukesh Ambani’s Jio. The entry of Mukesh Ambani into the telecom sector changed everything for Anil. Jio’s fortunes soared high, whereas, Anil’s Reliance Communications market plunged to 2 percent.

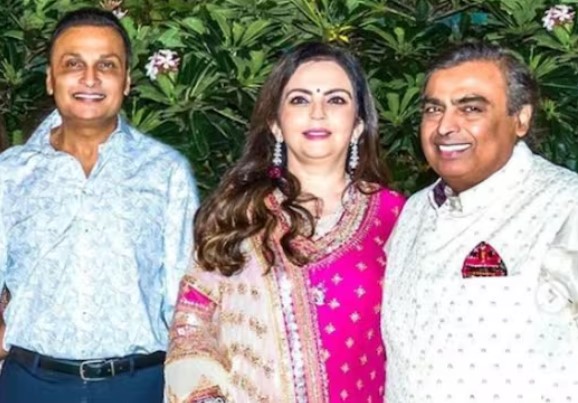

In 2019, the Supreme Court gave one month’s notice to Anil Ambani to clear the debt he owns to the Swedish telecom major, Ericsson or face a jail term of three months. At that moment, Mukesh Ambani stepped in and cleared the Rs. 453 crore debt that Reliance Communications owed to Ericsson and saved his brother, Anil. In a statement to the press, Anil thanked his brother, Mukesh and said:

“My sincere and heartfelt thanks to my respected elder brother, Mukesh, and Nita, for standing by me during these trying times, and demonstrating the importance of staying true to our strong family values by extending this timely support. I and my family are grateful we have moved beyond the past, and are deeply grateful and touched with this gesture."

In early 2020, Anil Ambani’s company, Reliance Communications, filed for bankruptcy. His other companies, too, faced financial difficulties as no one provided loans to him. He apparently filed an appeal in the court stating that he had run out of all the assets to sell.

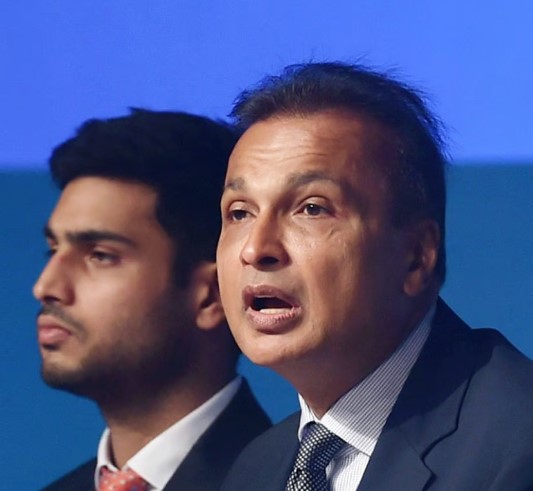

While Anil has declared bankruptcy, his sons, Jai Anmol Ambani and Jai Anshul Ambani, on the other hand, are doing very well in their careers. Jai Anmol Ambani joined Reliance Mutual Fund in 2014 and later became Reliance Capital’s executive director and a board member of Reliance Nippon Life Asset Management (RNAM) and Reliance Home Finance (RHF). Anil Ambani’s younger son, Jai Anshul Ambani, works as a management trainee with Reliance Infrastructure. He has also gained experience in Reliance Mutual Fund and Reliance Capital.

Anil Ambani’s business judgements and failure to compete in the cutthroat economic environment became the reasons for his downfall. What do you think about Anil’s journey from riches to rags? Let us know.

Recommended Read: Subrata Roy's Untold Love Story: When He Mortgaged Wife, Swapna Roy's Jewellery For His Business

advertisement

advertisement

advertisement